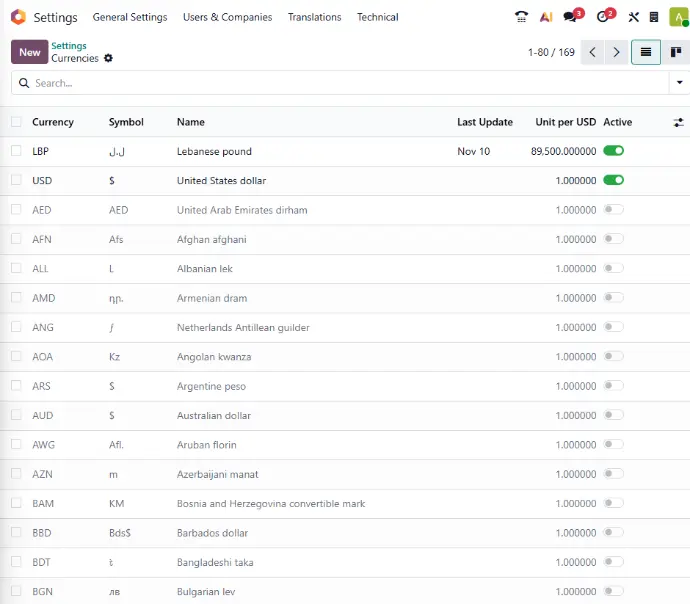

Multi-Currency Support

Handle all your transactions seamlessly across LBP, USD, and EUR with real-time exchange rate management. Our system automatically manages currency conversions and fluctuations, ensuring accurate financial reporting while maintaining full compliance with Lebanese Ministry of Finance regulations.

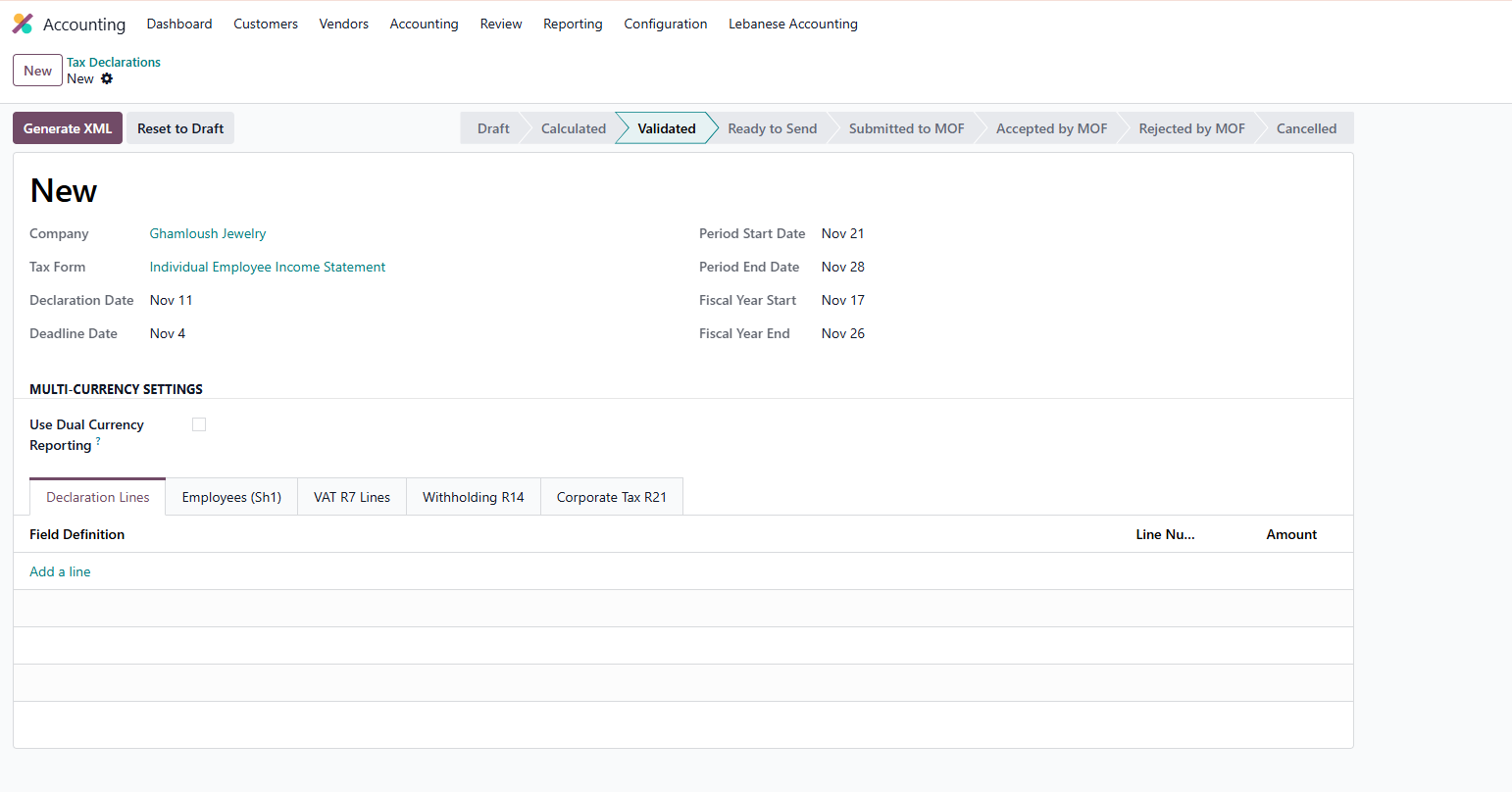

Tax Declaration & Compliance

Streamline your tax obligations with automated tax declaration features designed for Lebanese regulations. Generate MOF-compliant tax reports, manage VAT returns, withholding tax calculations, and salary tax declarations. The system ensures accurate tax computations and produces ready-to-submit reports that meet Ministry of Finance requirements.

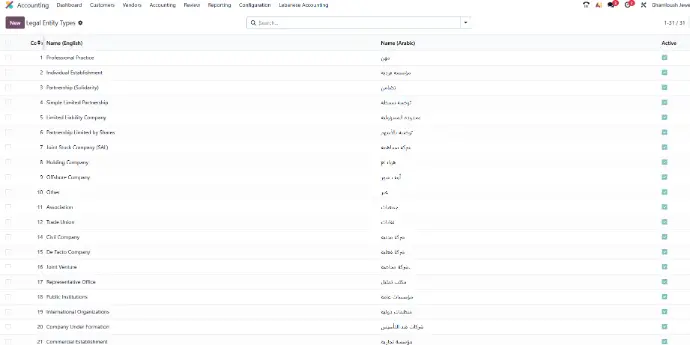

Legal Entity Management

Manage multiple legal entities effortlessly within a single system. Our solution supports complex corporate structures, enabling you to handle separate legal entities with consolidated reporting, inter-company transactions, and independent financial statements while maintaining compliance with Lebanese corporate and tax regulations.

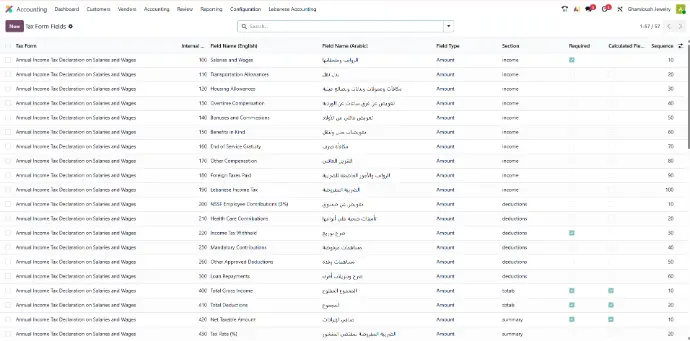

Comprehensive Tax Form Management

Our Lebanese Accounting module includes all essential tax form fields required by the Ministry of Finance. Easily manage and populate tax declarations including income tax forms, VAT returns, salary tax statements, and withholding tax reports. Every field is mapped to Lebanese tax regulations, ensuring accurate data collection and seamless report generation.

The system automatically validates entries, prevents common errors, and maintains a complete audit trail of all tax submissions. Whether you're filing monthly VAT returns or annual income tax declarations, all required fields are structured and ready for direct submission to authorities.